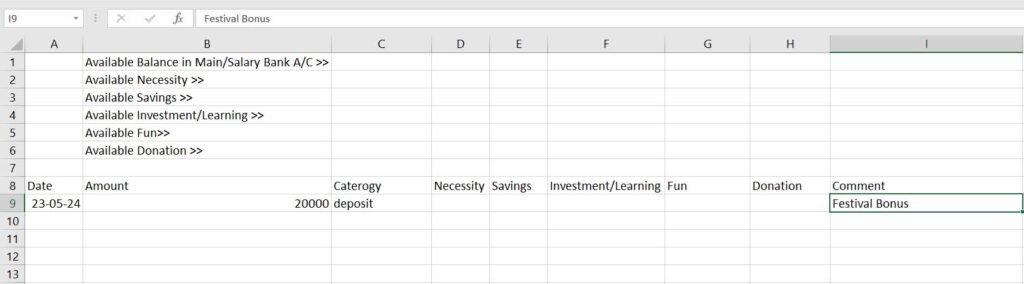

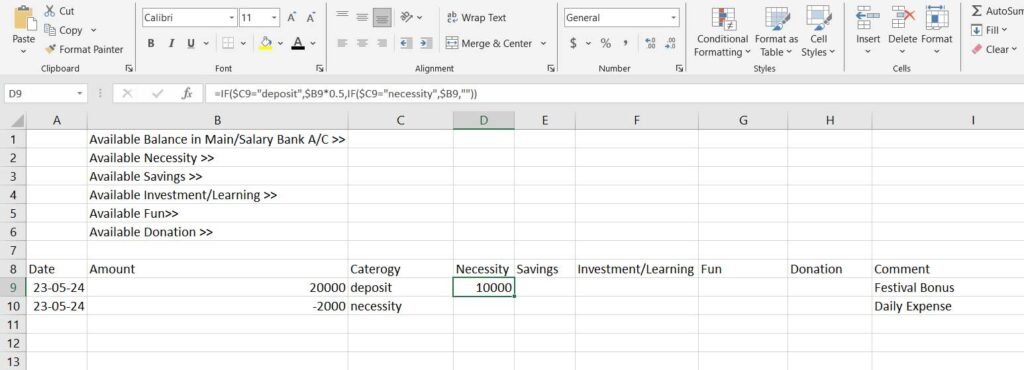

Let’s first draft how our Excel sheet will look.

This is the raw concept. I have to input only four things each time I deposit or withdraw money from my main account:

- Date

- Amount

- Category

- Comment (purpose of that transaction)

In the Amount column, if money enters into my main bank account, then the amount will be positive. If money is being withdrawn from that account, then the amount will be negative.

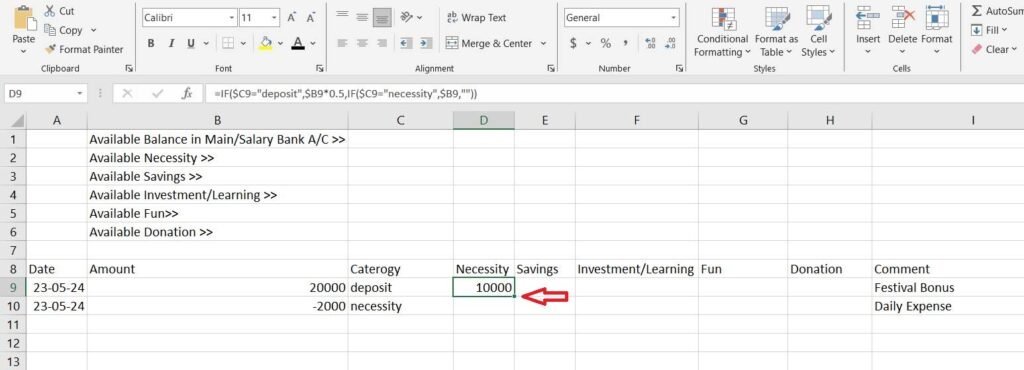

The amounts shown in the Necessity, Savings, Investment/Learning, Fun, and Donation columns will be automatically added depending on what I type in Category column.

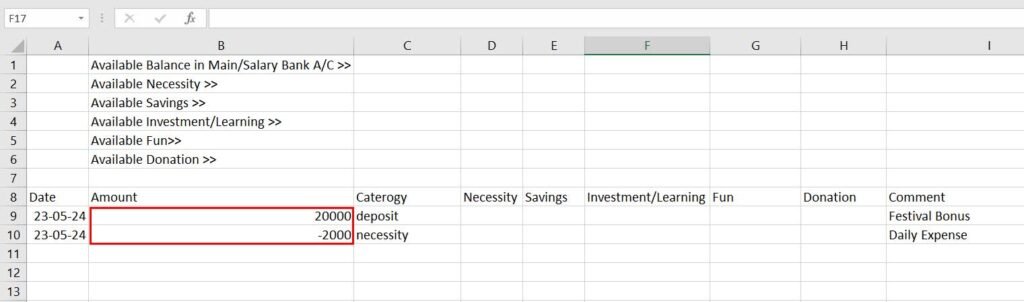

Formulas

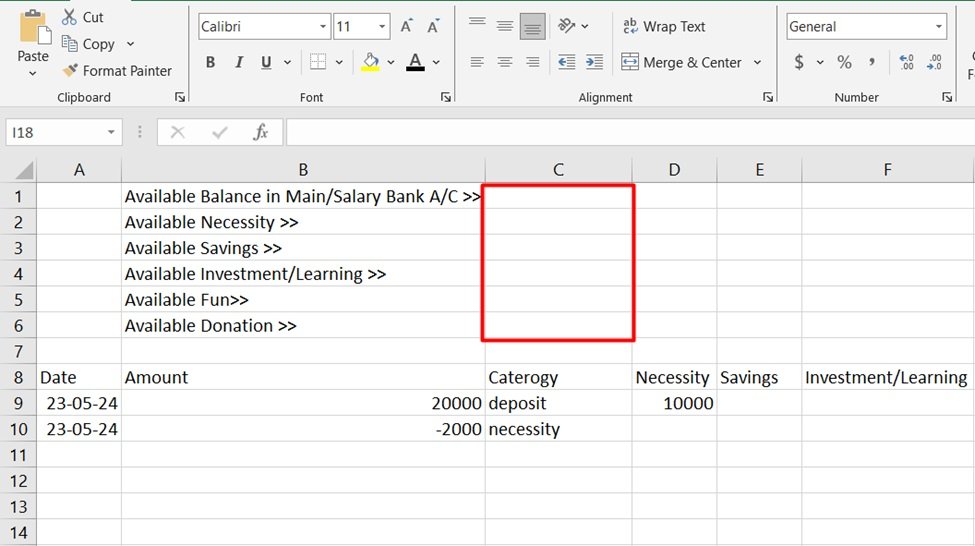

Now, only the upper part is left.

This is very easy.

For Available Balance in Main/Salary Account, in cell C1, use the formula: =SUM(B:B) It should match your bank account balance. Similarly, for Available Necessity, in cell C2, use the formula: =SUM(D:D) You can do the rest.

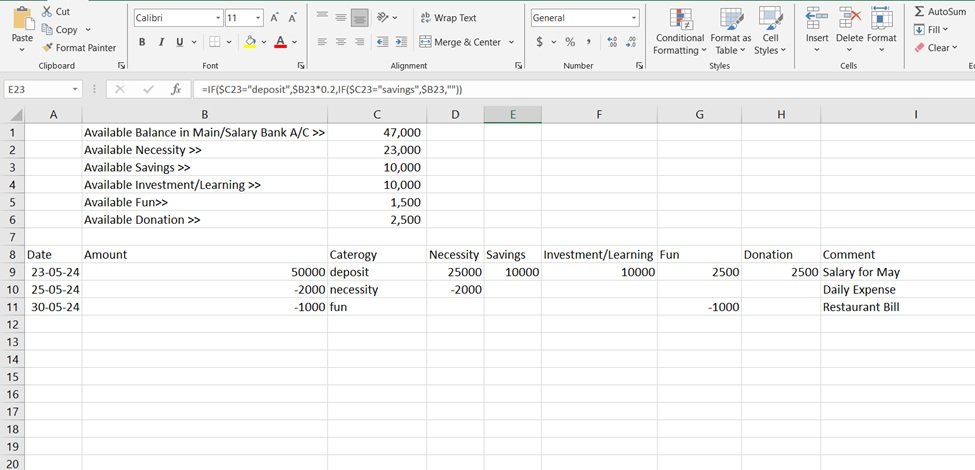

Finally, the Excel file will look like this.

From now on, you just need to add the date, amount, category, and comment.

Maintain this Excel file, and you will be one step closer to financial freedom.

To get the excel file, click here.